In theory, working with real estate private equity is quite simple: you pool money from property investors, find profitable opportunities, collect the yields of choosing the right places and grow the invested capital.

But, as we’re sure you know, the property market is a dynamic one, with real estate being sold and put for sale, appreciating and depreciating all the time, and also a market that’s affected by many different external factors as well. Meaning that identifying the best strategies to deploy capital can require a lot of skill and expertise, especially when markets are in turmoil.

The task of deciding when and where to invest has to go through a not-so-simple question of understanding what’s going on in the market.

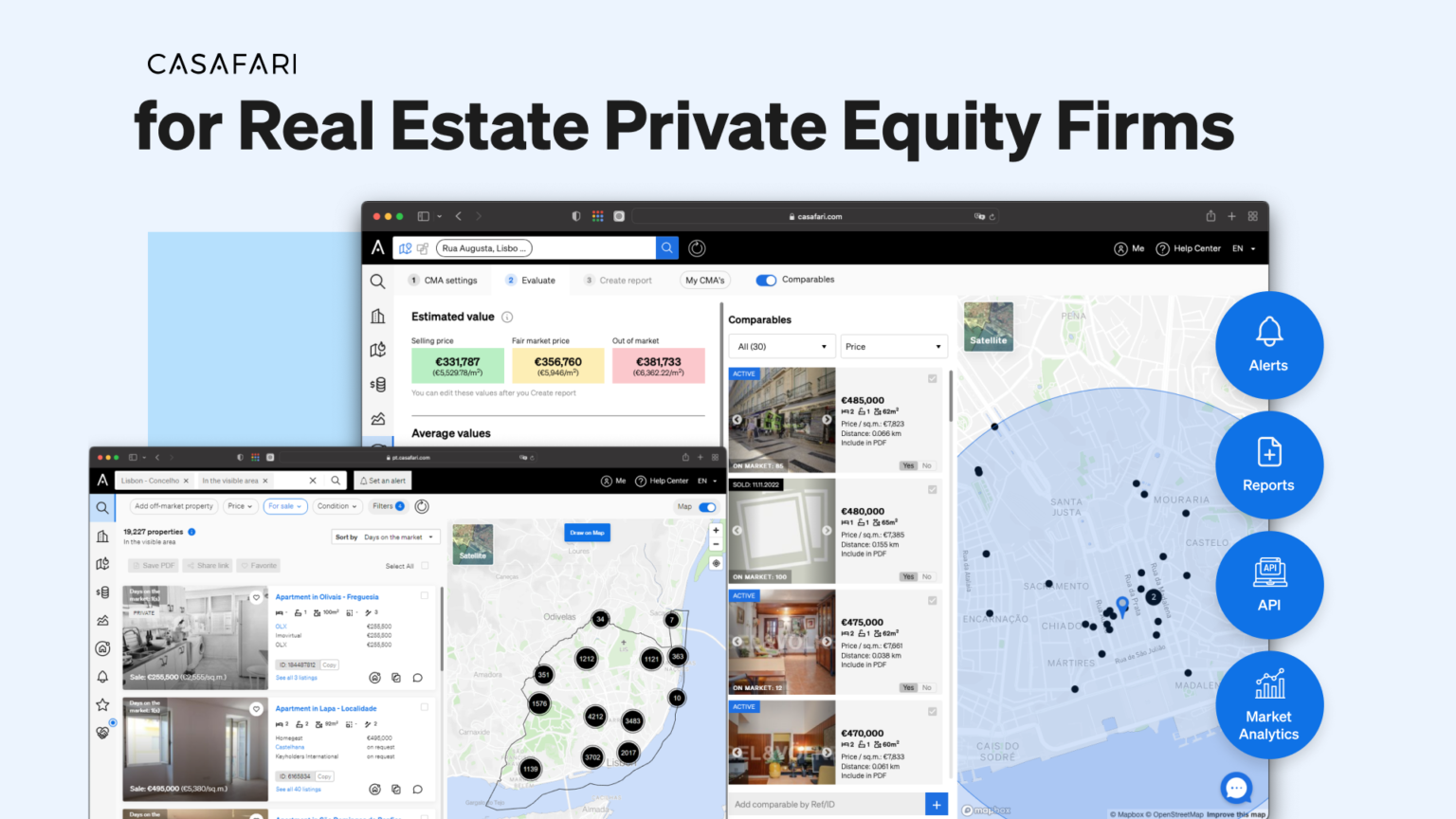

To help the private equity real estate firms in that matter, CASAFARI offers a selection of products that will not only keep you informed, but actually provide input as to which your next steps could be and how to take them. So, without further ado, let’s see which are these products and how to profit from them.

Find the best opportunities for your private equity real estate

With CASAFARI’s Property Sourcing you get a 360º, clean and organised view of the market: not only can you see everything that’s available, but you also get access to the full history of each property, so you’re updated about everything that went on with a piece of real estate.

All this updated data will put you in a privileged position, allowing your firm to find which properties can be acquired for the least amount of capital, , thus sustaining high desired yields.

To find desirable properties, you can filter your search inside CASAFARI per:

- Location;

- Price;

- Properties rented or for rent, sold or for sale;

- Condition (used, to refurbish, very good or new);

- Amount of rooms, built surface and plot;

- Construction year;

- Days on the market;

- Property type (houses, apartments, investment properties or buildings);

- Floor & orientation, as well as view & direction;

- With furniture or not;

- Energy certificate levels;

- Characteristics (balcony, parking, rental licence, etc.);

- Agencies and agents (including private sellers, banks and auctions).

Property sourcing with CASAFARI: work with a 360º view of property market

Once you select a few properties that fit your real estate private equity criteria, you can also look at our property pages, where you will find the following information:

- Built surface, plot square meterage, location and amount of rooms;

- Year of construction;

- How long it’s been on the market and the average time to sell or rent a property with these characteristics;

- Last price changes, transactional prices and expected yields;

- Photos and characteristics (parking, elevator, swimming pool, appliances, etc.);

- Which companies are selling it, for how much and their contact information;

- The history of the property;

- How is the property positioned on the market, in relation to price distribution.

Properties can be added to a Favourites folder, so you can gather your best findings. The property pages can be downloaded as PDF, shared through WhatsApp or Facebook or email, and receive comments, so your team can discuss your business decisions in detail.

Valuate properties properly for better decision making

Our Property Valuation is perfect for those working in private equity real estate: it helps decide whether to sell assets or not, as well as to valuate properties that they intend to buy so you can negotiate an appropriate pricing.

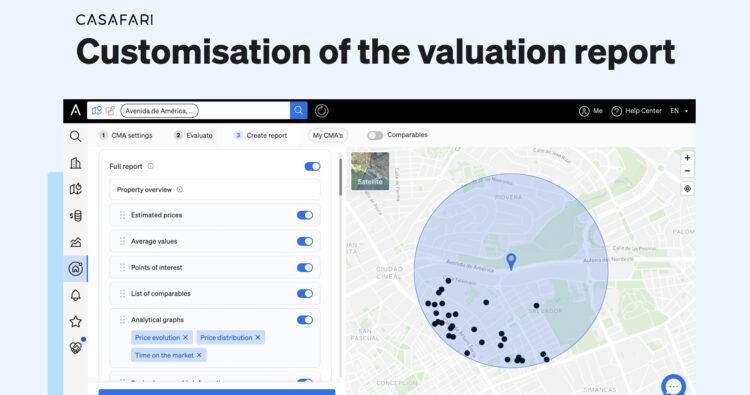

What our tool does is to find comparable competitor properties (with similar characteristics and the same location) for the one you’re analysing, in order to provide you with a suggested selling price, the fair market value and an out of market price.

The report also shows all the details of the analysed property, the price evolution for that location, the price distribution for real estate of the same typology and the average time that properties such as these spend on the market.

Finally, you can also see the points of interest existent around the property and socio-demographic data (population variation, unemployment rate and average income) about that location.

Understand the property market for informed investments

With CASAFARI Market Analytics, you get to understand the current behaviour of the market and which market trends are affecting the real estate investment scenario. It will allow you to:

- Identify which areas have higher or lower prices, for rent and sale, on a specific market;

- See how the prices are behaving across time, as well as see which regions show increases or decreases in cost;

- View how many properties there are within each price segment, whether for rent or sale;

- Discover average time spent a property spends on the market, per price segment;

- Monitor the average asking price (for the full property and per square metre) according to each typology;

- Check the market stock per typology.

Basically, this is all the information you will ever need to pinpoint where your private equity real estate firm should invest in.

CASAFARI Market Analytics: follow the property market trends

Set notifications and be the first to know about opportunities

With CASAFARI Alerts, you can automate searches that fit the criteria of your private equity real estate firm for interesting properties and get notified instantly when new ones are put on the market.

By getting to know first, you get to research all about the property inside our platform (like expected rental yields or its past history), run a property valuation and approach the seller with all the knowledge needed to seal the deal at a reasonable price.

Keep updated with the property market effortlessly

CASAFARI Market Reports save your time and effort, gathering all the information you need to make business decisions. There are many different reports available, each one with a purpose, so let’s see which ones would be suitable for those who work with private equity real estate.

- Comparables

This report compares a property to its comparables on the market. It can be done to big amounts of properties, in order to help you valuate the assets on your portfolio or potential investments.

- Market properties

With this report you can see the properties available at a specific market and all the information about each one of them. Our research can be refined with over 30 filters, so you get exactly what matters to your fund. It’s a quick way to find opportunities to invest in.

- Market Alerts

This report makes it easier for your real estate private equity firm to grow its portfolio with properties that are for sale by their owners. The document provides a list of properties and the contact information of the private sellers in an area of interest, so you can negotiate directly with the person in charge of selling, avoiding real estate agents’ commissions.

- Advanced Market Analytics

This report was designed for you to deepen your understanding of a specific market and decide whether investing there is the best option for your fund. Choose an area of your interest and get a customised document with all the strategic data that you might need from CASAFARI, the largest real estate database in Europe.

Interested in the market reports? Get in touch with our team of account managers and receive all the data you need!

CASAFARI’s Market Reports: the way to data-driven decisions

Out database, inside your platform

With CASAFARI’s APIs, your private equity real estate firm will be able to run your own analyses using our updated market data without having to switch softwares from the one you already use.

- Comparables API

This product was designed for you to run a Property Valuation, finding which are the comparable properties and deciding on the most accurate pricing strategy for a piece of real estate.

- Properties

See and get detailed information about all the market stock. Use CASAFARI’s filters to refine your searches and explore the market opportunities.

- Alerts

This API works the same way as our Alerts feature inside CASAFARI: set your searches, the frequency with which you want to be notified of results and stay informed about properties that are interesting to your fund.

The advantages of using CASAFARI’s property data API

Leverage your investments with a team of industry experts

Institutional investors might not have the time or be willing to take over all the effort involved in staying updated about the markets, searching for the highest yields at lowest rates and across different areas. But they still need to act fast, in order to get the best available units on the market.

Enters Portfolio Solutions unit, a team of highly skilled and experienced experts that are here to help you get the best out of your property investments, from the thesis formation to the property sourcing, and from the acquisition of the assets to its management.

CASAFARI creates Single-Family Renting Investment Unit

Are you ready to do more and better business? Waste no time: choose the CASAFARI products that better suit your needs and start exploring the inputs that the largest real estate database in Europe can provide you!