A shortage of supply that drives a continuous growth in property prices, inflation, increasing interest rates to buy property and harder access to capital are some of the affordability pressures leading to a higher rental demand across Europe.

This means that the scenario is ready for property investors to profit from rental yields, especially if they choose an advantageous strategy, like investing in Single Family Homes. Let’s talk further about it to understand how these portfolios are composed and their benefits.

What is a Single Family Home?

A single family home is a type of dwelling charaterised by the fact that only one family lives in it, like an apartment in a residential building or a typical house.

Traditionally speaking, when looking to build a property portfolio, investors look for Multi-Family Homes, which means buying multiple single family units within the same block or building. This is a relatively simple investment with potential returns, since the property investor will have many tenants.

But there are advantages to changing the investment strategy and buying Single Family Homes, only they were rarely explored until recently, especially because a property portfolio of this kind of product was hard to access.

As explained by Miguel Figueroa, Transactional Analyst in CASAFARI’s Portfolio Solutions team:

“In order to build a profitable portfolio of Single Family Homes it is determinant to constantly purchase at low prices, essentially being able to find the best opportunities that could offer attractive rental yields. This is only possible if you have an updated view of the market and its trends.”

Why should you invest in portfolios composed of Single Family Homes

This type of portfolio allows for a faster and more efficient adaptation to market trends in comparison to one based on Multi-Family Homes. This is true because the cost to invest is significantly lower, and thus more manageable, which provides an agility in transactions that is attractive to property investors. After all, the faster they buy, the faster they see the returns on their investments.

Another benefit of fragmented portfolios is that they present a risk mitigation factor, something valuable for property investors.

Imagine, for example, your property portfolio consists of a whole building located in an area that is undergoing a major crime wave or that’s been through a natural catastrophe, such as a big flood. Your risk in this situation will be naturally greater than if your assets were spread out in different areas. So, location here acts as a risk mitigation factor.

One more reason to opt for a diversified portfolio is that it provides property investors with exposure to a broader range of investment opportunities. Whilst the market for traditional portfolios made of Multi-Family Homes is becoming increasingly saturated, with a far more limited supply that is highly sought after, the opposite is true for portfolios of Single Family Homes.

The formula for results here is simple to see: lower costs and risks + better opportunities = unlocked potential growth.

The only thing that could make these fragmented property portfolios more interesting is speeding up the process of both finding spread investment properties with the best rental yields and making them generate profits. Hence the creation of CASAFARI Portfolio Solutions.

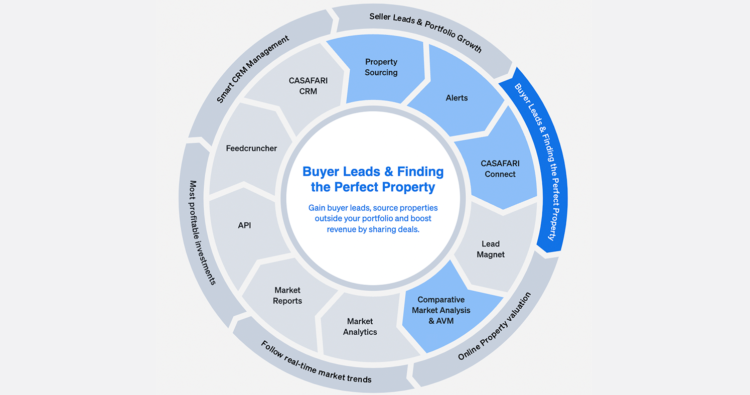

How CASAFARI Portfolio Solutions unlocks returns for real estate funds

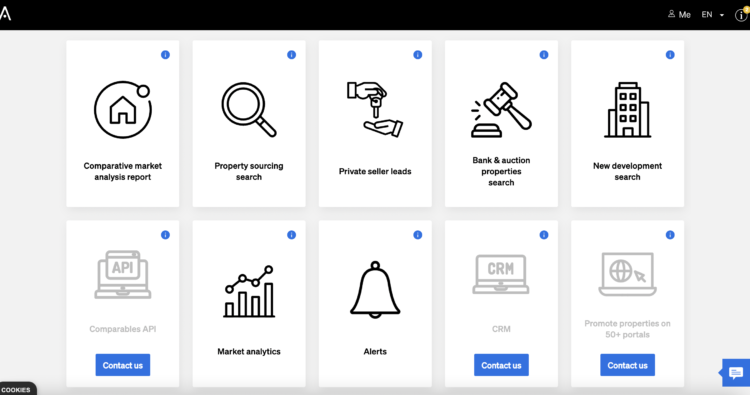

CASAFARI managed to solve the need for an updated view of the property market and the follow-up of its trends, both needed in order to build a profitable portfolio of Single Family Homes. How? By having the largest and most reliable real estate database in Europe, with over 310 million listings sourced from more than 30,000 agency websites, property portals, etc.

But having solely the database wouldn’t be enough: we needed professionals that could use it for the benefit of institutional property investors.

Enters Portfolio Solutions, a team of real estate experts that use CASAFARI’s data to do a systematic identification of opportunities in the market, allowing for the successful commercialisation of portfolios of Single Family Homes.

Portfolio Solutions’ team provides a thorough service, from the property sourcing to acquisition, including the property portfolio management until the investors are ready to sell their assets.

Are you interested in knowing more about how portfolios of Single Family Homes can be quickly sourced and turned into profit? Get to know more about this investment opportunity with CASAFARI!