Famous in the USA property market, the house flipping trend has arrived in Europe. It brings the idea of buying cheap and renovating properties to sell for a higher price.

But what are the risks that come along with it? Are there differences between buying to sell fast or buying expecting that the property appreciates? Which are the best practices that should be followed to reduce the potential risks and ensure the desired profitability?

Keep reading to see these questions answered in the article.

What is house flipping?

Flipping a house means buying a property, renovating it to increase its market value and selling it shortly after – something that works especially well in markets with a high demand. The return here is smaller, but faster than the more traditional method of Buy & Hold for real estate investments, in which the property investor awaits for an appreciation over the years before selling.

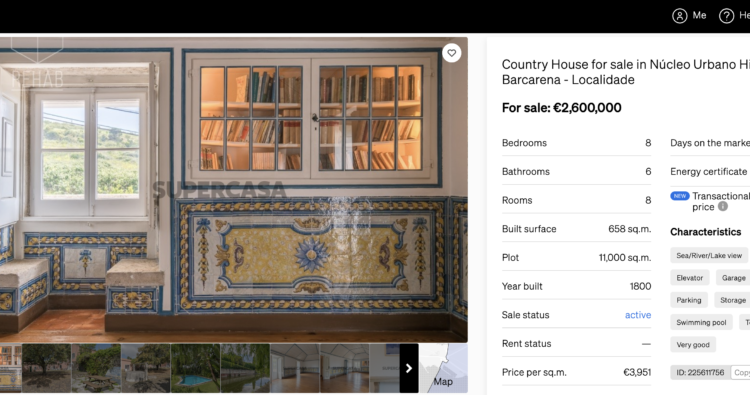

The aim here is to find underpriced fixer-uppers, those properties that are being sold below the market price due mostly to cosmetic reasons – things that could be fixed fast and without much investment.

This doesn’t mean that buying properties with structural needs isn’t a good idea, but it does mean that the buyer will have to do the maths to see how much they can invest in order to still have some return when selling.

And although this is a good idea for property investors and estate agents alike, since both ends increase their revenues with house flipping, it is not a risk-free one. The main risks involved are the renovation cost becoming more expensive than planned and the property taking longer to sell than what’s expected.

Let’s see a few good practices to reduce these possibilities.

Step by step to successfully flip a house

Identifying underpriced properties

In order to flip a house, property investors and their estate agents need to find which are the underpriced properties in the city that have the potential of being sold fast, after the renovation.

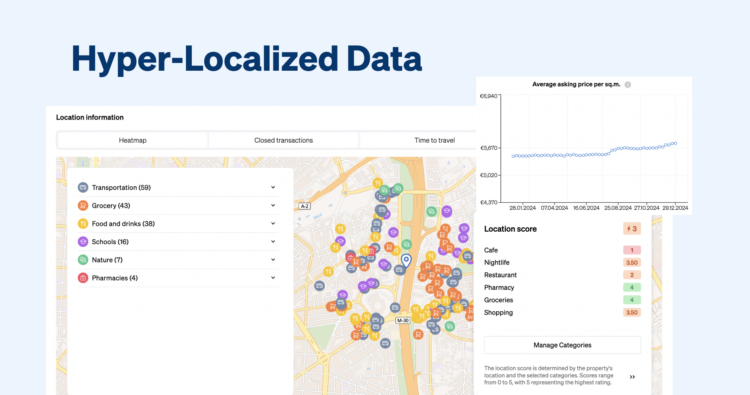

With CASAFARI Market Analytics, the estate agent can analyse the scenario with:

- a chart with underpriced properties per kind of asset;

- a chart with the average time a specific typology spends on the market, per price segment.

CASAFARI Market Analytics: follow the property market trends

With this information in their hands, the professional can advise the buyer as per which are the interesting properties for house flipping and which should be avoided.

And, once these underpriced properties show up, the property investor needs to act fast, right? So, the estate agent can set Alerts inside our platform to be notified when properties with the desired characteristics and asking price show up.

Gather more property leads with CASAFARI: get to know Alerts

Calculating the purchase value

One way often used to calculate how much the buyer should invest to flip a house is called the 70% rule. Basically, it means that the maximum buying price should be 70% of the after-repair value minus the estimated costs of the repair.

But it’s important to see that this is a general practice that may or may not work, according to each market: the labour to carry out the repairs may be expensive or the area may be under a lack of stock that increases the prices of all properties, for example. So, basically, the purchasing value should be assessed on a case-by-case basis.

In order to do so, it’s important to understand the market very well, especially when it comes to the average asking price per square metre for a property such as the one about to be purchased and to how much its comparable on the market are being sold for.

This market knowledge can be found inside CASAFARI Comparative Market Analysis, a tool in which you can find the comparables of a property and get a suggested fair market value for it.

How to make a comparative market analysis with CASAFARI

Visit the property and analyse its conditions

There are many reasons for a property to be underpriced. Some of them are:

- the seller’s lack of knowledge about the prices practised on the market;

- structural damage that’s costly to repair;

- the seller’s need to sell quickly due to divorce, the division of an inheritance or other personal matters;

- the property being rejected by potential buyers due to old-fashioned decor or poor maintenance, that makes the property seem in poor conditions.

The investor interested in flipping a house and their estate agent need to carefully analyse the property and talk to the seller’s agent to understand what is really going on.

Sometimes, simple changes can change the way a property is perceived. A coat of paint and some new tiles can make the property seem cleaner and more attractive. Double-paned windows can make the whole environment a lot more comfortable during summer or less humid and prone to mould during the winter. A new home-office corner can make it adapted to the reality of remote workers.

If possible, another good idea is to bring the contractor already with you on the visit, so they can provide a realistic estimate when it comes to the changes needed.

Enlist a group of workers you can count on

To guarantee that the property will be improved and sold in no time, the chosen contractor and their team must be trustworthy, delivering a quality job that follows the schedule and stays within the budget.

Another important point is that they should pay attention to the prices of the materials used and have knowledge of the suppliers in the area, so they can find those that will sell the needed materials for a good price and deliver fast.

Make sure you’re able to sell the property fast

The investor will need to also count on an estate agent that is ready to find a buyer for the property. This involves having a clientele of potential buyers or network of other professionals that could work alongside them to find someone interested.

But even the most efficient of estate agents may not find a person who wants to buy the property for sale, right? This is where CASAFARI can help you.

For the purpose of expanding the clientele and speeding up the sale process, estate agents can use CASAFARI Connect, a platform that promotes the partnership between these professionals.

Through a transparent and safe commission-sharing process, agents from both parties work together, finding the perfect property for the buyer and selling the property for the owner – a match made in Proptech!

How CASAFARI Connect boosts property deals and who is it for

So, as we said, house flipping is not a risk-free investment, but these risks can be alleviated by working with the right team and basing your decisions on updated market insights. This is where CASAFARI comes in: you can boost your deals with our tools, finding all the data needed for you to obtain the returns possible.