Lisbon, November 2, 2021. CASAFARI, the leading real estate data platform in Europe, has extended its Series A round to $20 million, including a strategic investment from an affiliate of Starwood Capital Group, a global private investment firm. CASAFARI is Europe’s only independent real estate network connecting more than 20,000 real estate professionals to 125 million property listings.

The new funding will support CASAFARI’s continued growth, including investment in its data science, product and engineering capabilities. It will also use the fresh capital to expand its operations to Germany in January 2022 and roll out its Portfolio Solutions – the company’s new service which lets institutional investors build their own tailored portfolios of single-family rental homes. The partnership with Starwood Capital will provide CASAFARI with deep real estate industry experience and expertise as CASAFARI rolls out their Portfolio Solutions service.

“CASAFARI’s real estate data platform simplifies analytics from a wide range of fragmented data sources, enabling investors to efficiently source single-family homes at scale. We are excited to partner with CASAFARI as Starwood Capital continues to pursue innovative investment strategies and work with leading PropTech companies.”

Leander McCormick-Goodhart, Vice President at Starwood Capital

“We started CASAFARI with a mission to bring a positive impact to local communities. We tackle chaos and information asymmetry in real estate through an organised and efficient ecosystem enabled by our proprietary data technology and AI. We are very excited to partner with Starwood Capital to build a market leading company revolutionising the way properties are transacted in Europe.”

Mila Suharev, CASAFARI’s Co-CEO, Product and Data

According to Nils Henning, Founder and CEO

“As one of the largest multifamily and single-family residential owners in the United States, we are proud to have Starwood Capital onboard. We built Europe’s largest network of real estate professionals, gained the trust of all major brands and set a new standard in real estate SaaS technology. CASAFARI’s new Portfolio Solutions service has already secured mandates of more than $250 million to invest in single units for long term rental, bringing liquidity to markets and accelerating transactions for brokers.”

About CASAFARI:

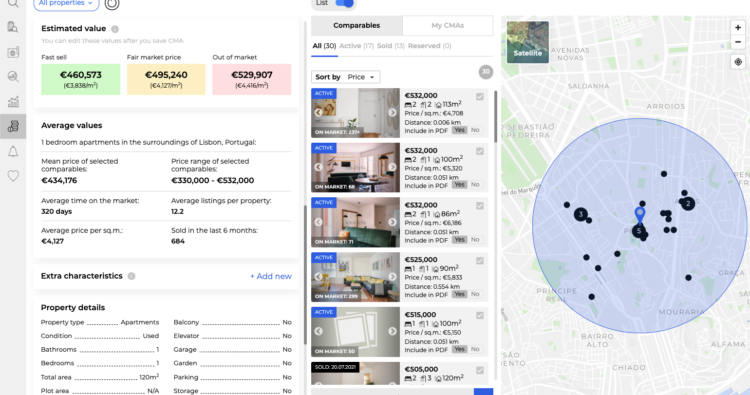

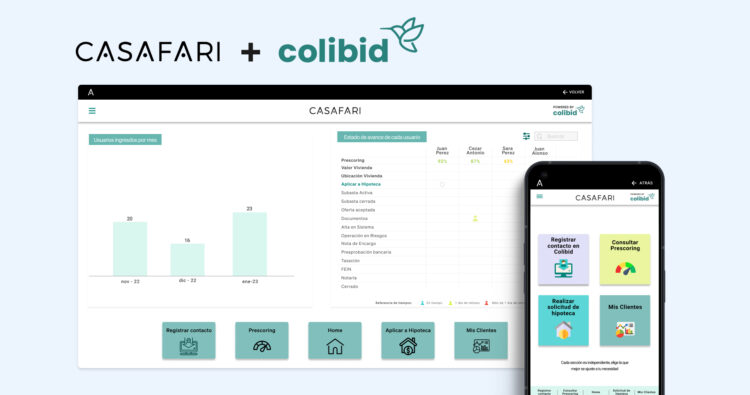

CASAFARI, Europe’s only independent cross-border real estate network, connects more than 20,000 real estate professionals through MLS functions and a complete real estate database covering all asset classes in Spain, Italy, France and Portugal. CASAFARI developed custom applications such as a metasearch, comparative market analysis, market analytics, and daily data feed, as well as a Portfolio Solutions division to serve the needs of Institutional Real Estate investors.

The company has a proprietary machine learning technology and extensive data operations to automatically index, clean, classify and match duplicates of millions of property listings from thousands of websites in different languages.

Since launching in 2018, CASAFARI has won major clients from brands such as Sotheby’s International Realty, Century21, Coldwell Banker, RE/MAX franchises, JLL, Savills, Fine & Country, Engel & Voelkers, Keller Williams and important institutional investors and developers like Stoneweg, Kronos, Vanguard and Vic Properties.

About Starwood:

Starwood Capital Group is a private investment firm with a core focus on global real estate, energy infrastructure and oil & gas. The Firm and its affiliates maintain 16 offices in seven countries around the world, and currently have approximately 4,000 employees. Since its inception in 1991, Starwood Capital Group has raised over $65 billion of capital, and currently has over $95 billion of assets under management. Through a series of commingled opportunity funds and Starwood Real Estate Income Trust, Inc. (SREIT), a non-listed REIT, the Firm has invested in virtually every category of real estate on a global basis, opportunistically shifting asset classes, geographies and positions in the capital stack as it perceives risk/reward dynamics to be evolving.

Starwood Capital also manages Starwood Property Trust (NYSE: STWD), the largest commercial mortgage real estate investment trust in the United States, which has successfully deployed over $72 billion of capital since inception and manages a portfolio of over $19 billion across debt and equity investments.

Over the past 30 years, Starwood Capital Group and its affiliates have successfully executed an investment strategy that involves building enterprises in both the private and public markets. Additional information can be found at starwoodcapital.com.