Diversification is a cornerstone of sound real estate investment strategy, offering benefits such as risk mitigation, stability, access to diverse income streams, and exposure to a wide range of investment opportunities.

By maintaining a diversified property portfolio, real estate investors can optimise returns, minimise volatility, and build a resilient investment portfolio capable of delivering sustainable long-term growth.

Let’s see a few strategies of how to do so and how CASAFARI can help you with it.

How to diversify your real estate portfolio

Diversifying a real estate portfolio involves spreading investments across different types of properties, markets, and investment strategies to reduce risk and enhance returns. Here are a few strategies investors can employ to achieve diversification:

1. Invest in different property types

Invest in a mix of property types such as residential, commercial, industrial, and retail. Each property type reacts differently to market cycles and economic conditions, providing balance to the portfolio. For instance, while residential properties may offer steady rental income, commercial properties may provide higher potential for capital appreciation.

2. Go for geographic diversification

Investing in properties in different cities, regions, or countries helps mitigate risks associated with local economic downturns, regulatory changes, or market fluctuations. It also allows investors to capitalise on growth opportunities in emerging markets.

3. Choose investments according to a risk allocation strategy

Allocate capital strategically based on risk tolerance and investment objectives. For example, allocate a portion of the portfolio to low-risk, income-generating properties for stability, while allocating another portion to higher-risk, growth-oriented investments for potential capital appreciation. Balancing risk across different investments helps achieve a diversified portfolio.

4. Vary the property size

Invest in properties of varying sizes within the real estate market to provide access to different tenant demographics and market dynamics. For instance, diversify between large-scale commercial properties and smaller stores, bigger multifamily units or tiny lofts suitable for single tenants and students.

5. Invest in sector diversification

The same logic applies to investing in varied sectors: going for niche sectors, like healthcare or hospitality for example, minimises the exposure to sector-specific risks.

By implementing these strategies, real estate investors can build a diversified portfolio that reduces risk, enhances returns, and withstands various market conditions and economic cycles. Also, a regular monitoring and rebalancing of the portfolio are essential to maintain diversification and optimise performance over time.

How can CASAFARI help you with that

Now that we understood how important it is to work with different markets and property types to increase revenues as well as prevent future problems when building a property portfolio, it’s time to see how technology can help you do that.

CASAFARI has many different possibilities for you to deep-dive into a market and find the best assets it has to offer.

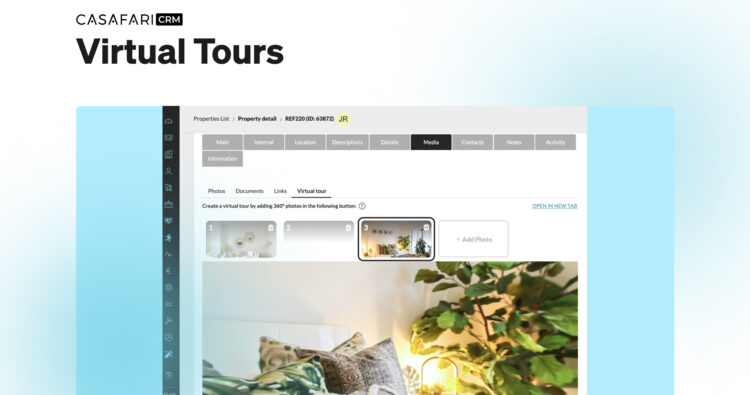

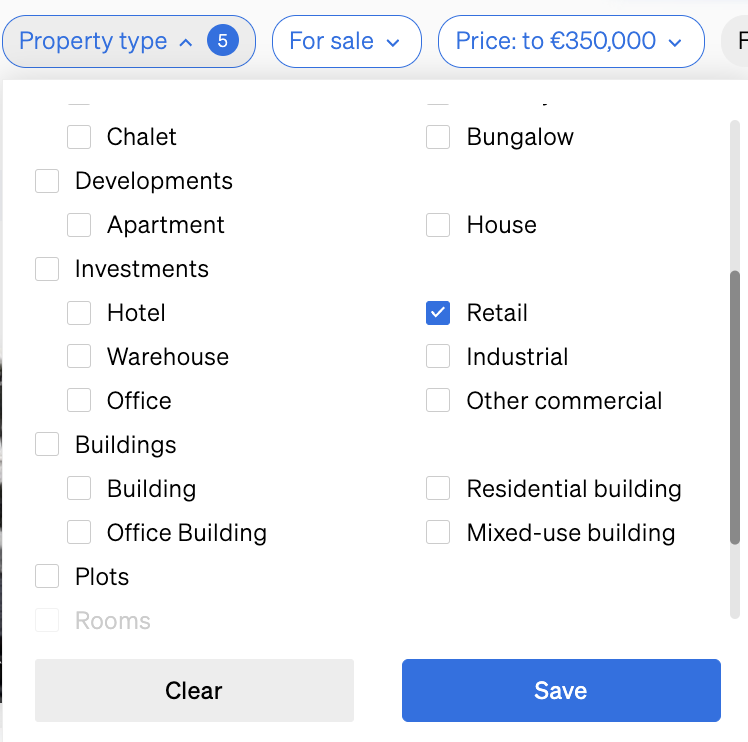

Property Sourcing: the search for different types of properties

CASAFARI’s Property Sourcing offers a comprehensive view of all properties available on the market, catering to a wide range of investor preferences and needs. Through the Property Type filter, investors and their representing agents gain access to an extensive array of property types, ensuring they can find options suitable for various investment strategies and objectives.

Here are some examples:

- Different kinds of apartments (such as duplexes, studios and penthouses);

- Diverse housing options (like chalets, townhouses, villas, and bungalows);

- Hotels;

- Warehouses;

- Offices;

- Retail spaces;

- Industrial properties;

- Buildings for varied purposes;

- Plots;

- Garages.

With such a comprehensive range of property types available at different markets, Property Sourcing enables investors and agents to efficiently identify and evaluate opportunities across the entire real estate market spectrum.

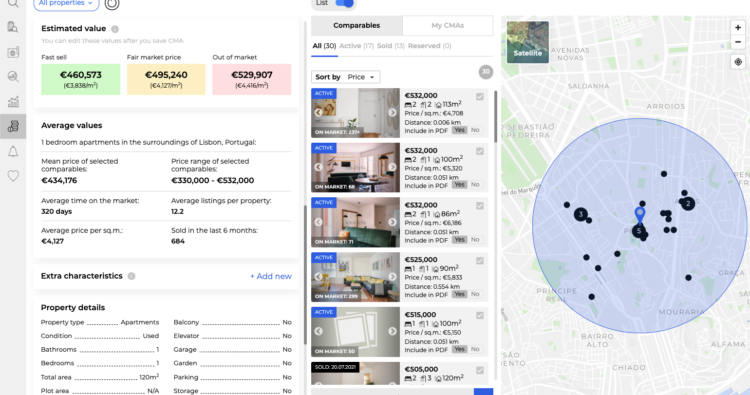

Market Analytics: finding the market opportunities

CASAFARI Market Analytics empowers real estate professionals to identify emerging markets that have been appreciating over time or show potential for future appreciation.

The platform’s time series analysis provides insights into the rises and decreases of average property prices and price per square meter over various time frames. This information allows agents to track market trends and identify areas where property values have been steadily increasing, signalling potential opportunities for investment.

Furthermore, this product simplifies the process of identifying underpriced properties that may be attractive to investors on the price per square metre chart, through the platform’s Price Distribution feature.

CASAFARI Market Analytics: follow the property market trends

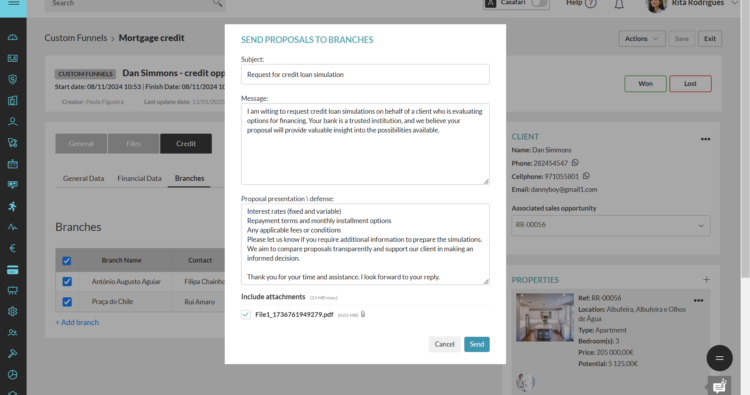

CASAFARI Connect: partner with other professionals to expand your investment horizon

With this feature of our Property Sourcing, real estate professionals can partner in deals with peers from other markets. Meaning that, if the investors are represented by estate agents, they can explore portfolios of agents elsewhere and negotiate exclusive deals to expand the investor’s portfolio.

Basically, by partnering with other professionals, you can benefit from their expertise in areas of the country or the continent that you’re not used to investing in, finding market opportunities faster and easier than when exploring by yourself.

How CASAFARI Connect boosts property deals and who is it for

Waste no time: diversify your assets and profit from CASAFARI’s market expertise to protect and enrich your real estate portfolio!