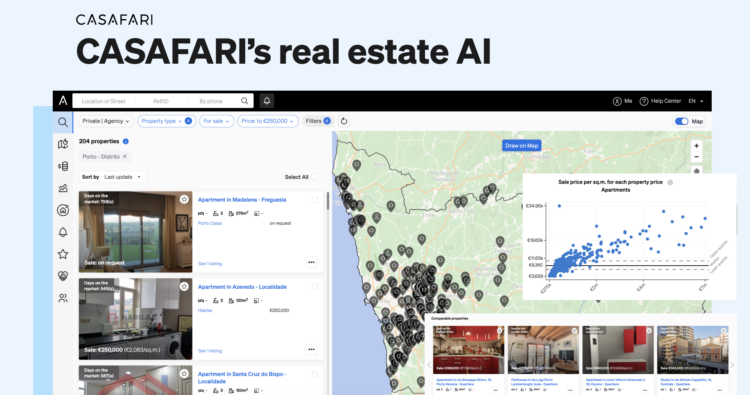

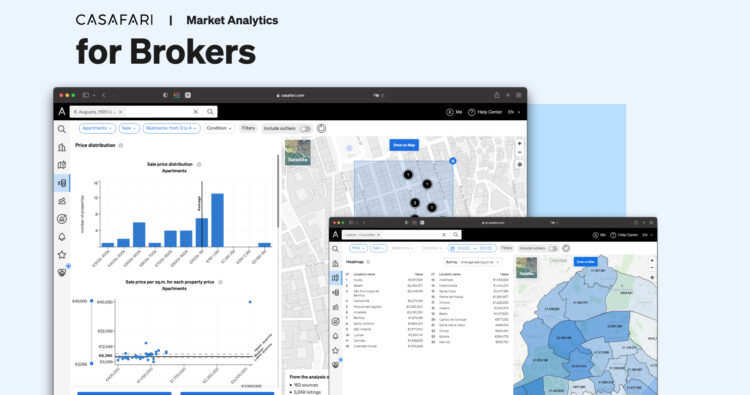

This month one of the leading luxury real estate agencies in Ibiza wrote an article about how Big Data helps real estate agents make faster and better decisions. CASAFARI has developed a platform for agents to make the most of data usage in their transaction process. Have a look at why data is important and how you can improve the lifecycle of your portfolio of property investments.

Improved Decision Making

It is widely known that knowledge and understanding of the real estate cycle and its genuine interpretation is the key to make better data driven decisions that can save time and money. Whether it is a private purchase or an investment into the property, it is now essential to understand the market trends and the price formation cycle.

Traditionally, the property or land price has been little accessible and having only structured data was hardly possible to determine the actual picture of the situation in the real time. Currently, this has changed considerably thanks to the Big Data allowing us to capture and analyze huge amount of data to discover trends and patterns.

The evolution of the real estate market has accelerated and the cycles have developed so rapidly only in few years’ time. It is no longer possible to see only the “picture” of the moment and be able to make great decisions. It is necessary to analyze the change, the tendency and, most importantly, notice the movement. It is essential to see the whole “video” rather than just the “picture” of the given time.

It has always been said that the most important thing during the investment stage is to choose the location of the property very well, as the famous and repeated mantra says: location, location, location… Now, the Big Data allows us to analyze more dynamic and complex information.

In addition to the location of the property, we are now being able to observe the market trends, determine where those trends are moving and get tangible insights. It allows us to utilize the Big Data to make strategic decisions, to better understand the appropriate timing and decide if this is the best moment for property investments, rather than make decisions based on best practices and previous experiences.

Careful analysis of the Big Data can also help us to identify the right clients and provide better, more customised services by improving the accuracy of emails or even general marketing activities, hence reduce the business cost.

Real Estate Analysis

As discussed above, the Big Data is booming and transforming the industry creating endless opportunities when analyzing the market models and trying to understand whether the property is worth the investment. When selecting a specific property or land for sale, it is possible to analyze the location, neighbourhoods, residences or sales patterns and therefore reduce the risk of buying or investing in the wrong property.

The Big Data provides estimated home value by comparing similar properties or plots in the given area. It demonstrates the pattern of sales prices by comparing the characteristics of the area, family household, current and future house value, square footage of the property, views (e.g. mountains, city, ocean), number of bedrooms and other important amenities.

Latest Big Data made it all possible for real estate developers to provide that information to potential buyers as well as to understand what sells more and increase their businesses in the way that client wants to perceive it.

In summary, the Big Data comes with big promises. Implementing the use of it provides many benefits for real estate developers, such as an ability to gain insight into client behaviour and spot trends and patterns in property investments’ cycle, improve customer service which definitely reduces the business expenses and refines decision making process.

However, to be able to make the most of analytics, extract and understand correlations and causal relationships which are embedded in the large data is quite challenging. First of all, misinterpretation of data is quite common as it reveals the actions and activities that took place however it cannot tell you why it happened therefore often assumptions lead to false correlations.

One of the ways to reduce the difference between the Big Data and analysis is to include a human into the mix. Technology is not at the stage yet to be able to analyze findings and make decisions without human intervention and judgement.

Author: unikibiza.com